This analysis is a condensed extract from today’s PAID EDITION of the Bitcoin Forecast.

Understanding of the current state of the market

In Bitcoin bull markets the price will always pull back to test the resolve of new buyers, we call this “the shake-out of weak hands”:

price starts dropping

new buyers sell under fear

experienced investors buy the dip

The experienced investors tend to be well capitalised and their buying power easily bounces price upwards quickly. This results in a v-shaped price recovery like this.

In circumstances when the shear size of selling is immense, a fast v-shaped recovery is not possible. Instead it takes time for the coins dumped onto the market to be re-accumulated. This results in a prolonged sideways band which we call an accumulation bottom.

We normally see this scale of selling at the end of bear markets, when maximum pain forces the last investors out right into the hands of smart money buyers stepping in to buy at the bottom at fire sale prices.

The current situation is very unique for a Bitcoin bull market in that the normal dynamic got flipped. The new participants that switched to selling were well funded speculative whales, while the buyers who have absorbed these coins have been less capitalised long term holders.

Speculative whales spotted

We collected an unprecedented number of new whales on the run up to $45k, their buying added fuel to the bullish price action, however by February these “speculative whales” have been profit-taking, dumping large amounts of coins onto the market.

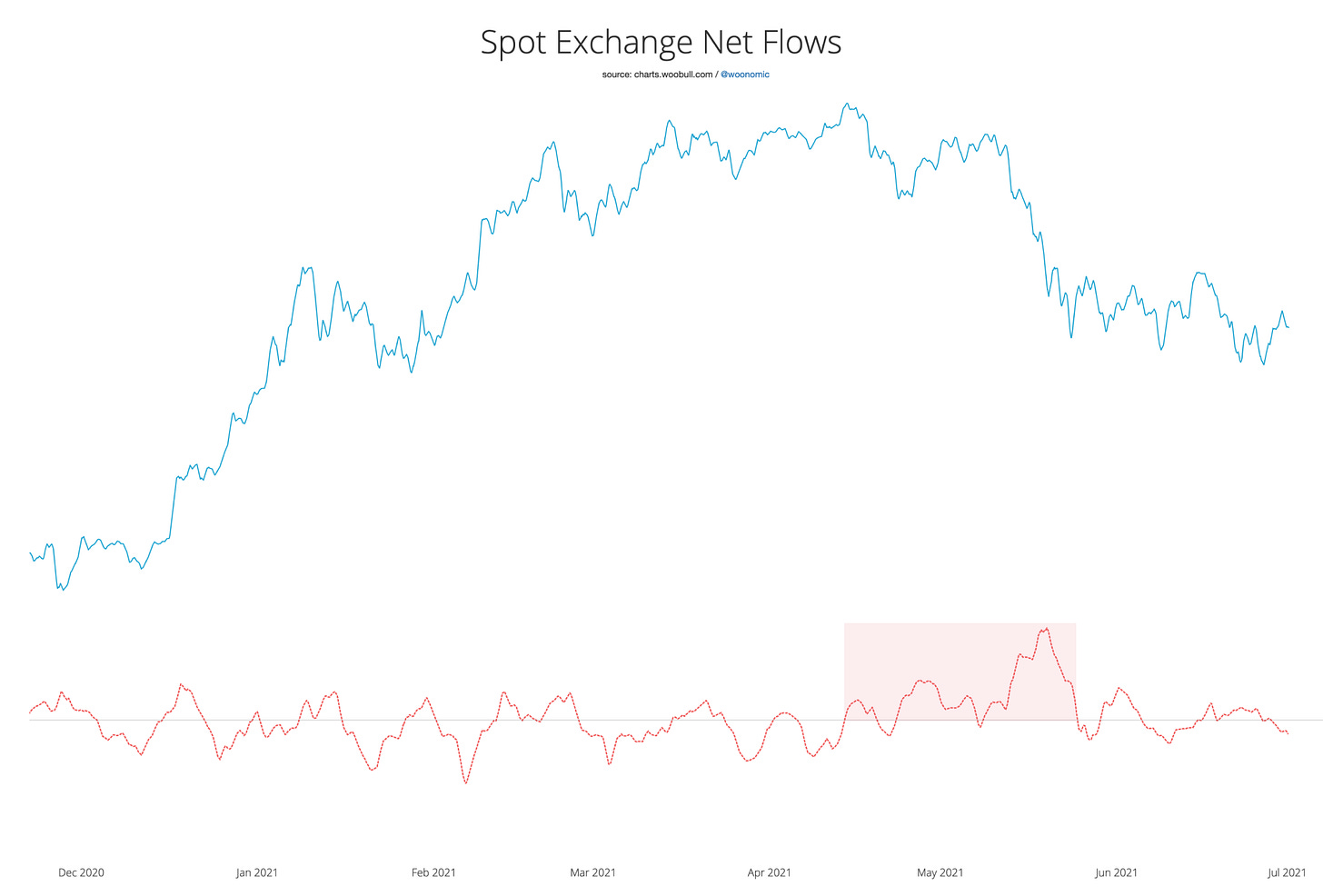

By April the selling overran the normal bull market buying pressure causing a final influx of coins swamping exchanges to sell. (The scale of the selling was the reason why I forecasted the likelihood of a multi-month recovery as early as 18th May.) An accumulation bottom was on the cards rather than a v-shaped recovery.

While the exchange flow chart above shows the sell-off has subsided, we really need to look at the quality of holders that the coins are moving to.

Our “Rick Astley” chart below shows the movement of coins between long term holders and speculative participants.

It’s very clear to see that long term holders are mopping up the speculative coins at a strong pace. It’s now a waiting game until this is reflected in the price action, the data is confidently pointing to an accumulation bottom forming.

A supply shock is quietly forming unnoticed by the market. In the chart below I’ve remixed the “Rick Astley” data, this time showing the ratio of coins held by strong and weak hands.

The coins that were dumped by whales onto speculators are now being absorbed by long term holders. We are now at supply shock levels last seen when price was at $50k.

We seldom see these divergences where coins are removed from the market without price action reflecting this. Assuming there are further no unforeseen impacts to drop, it’s only a matter of time before the market figures out the coins are drying up. A great opportunity is at hand.

Disclaimer

THE BITCOIN FORECAST DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES, REPRESENTATIONS OR ENDORSEMENTS WHATSOEVER WITH REGARD TO THE REPORT/BLOG. IN PARTICULAR, YOU AGREE THAT THE BITCOIN FORECAST ASSUMES NO WARRANTY FOR THE CORRECTNESS, ACCURACY AND COMPLETENESS OF THE REPORT/BLOG.

YOU ARE SOLELY RESPONSIBLE FOR YOUR OWN INVESTMENT DECISIONS. WE ARE NEITHER LIABLE NOR RESPONSIBLE FOR ANY INJURY, LOSSES OR DAMAGES ARISING IN CONNECTION WITH ANY INVESTMENT DECISION TAKEN OR MADE BY YOU BASED ON INFORMATION WE PROVIDE. NOTHING CONTAINED IN THE REPORT/BLOG SHALL CONSTITUTE ANY TYPE OF INVESTMENT ADVICE OR RECOMMENDATION (I.E., RECOMMENDATIONS AS TO WHETHER OR NOT TO “BUY”, “SELL”, “HOLD”, OR TO ENTER OR NOT TO ENTER INTO ANY OTHER TRANSACTION INVOLVING ANY CRYPTOCURRENCY). ALL INFORMATION PROVIDED BY THE BITCOIN FORECAST IS IMPERSONAL AND NOT TAILORED TO YOUR NEEDS.

BY USING THIS REPORT/BLOG, YOU ACKNOWLEDGE THESE DISCLAIMERS.