Welcome to The Bitcoin Vector Lite 001.

In our last Bitcoin Vector publication on 18 Jun, we covered how BTC price action was in a pure tactical regime dictated by speculative wars to liquidate short and long positions under a very neutral capital flow environment and with little correlation to traditional markets. Most of the liquidations were to the downside and price hit our 97k target before bouncing.

Top-level summary for 25 Jun 2025 (Current Price: $107.2K):

We're in a tactical reversal liquidating short positions in the absence of real investor flows to support it. This could properly turn mid term bullish if long term investors start chasing. For now it's a wait and see to see how the tactical speculation games resolve relative to real investment in coming weeks.

Price targets

Buy the dip

106k technical support

103k long liquidation

Bulls

110k short liquidation

112k short liquidation

Structure at a glance

DON’T GET REKT!

All models are probabilistic. Markets are subject to unpredictable events and the randomness of markets, please use appropriate risk management.

Short Term View

Capital flows into the BTC network remain neutral to bearish. Without increases in capital flows by incoming investors, any BTC rally remains short term tactical without fundamental tailwinds. Our leading indicator of speculative flows hints at future bullish flows given it has started bouncing.

We expect in this neutral flow environment price will continue to move tactically.

In that regard, bears are oversold and bullish speculators will have an easy time as BTC rubber bands back up from selling down too much. Our onchain VWAP is now picking up a reversal of deep overselling. We should note there’s still a lot of medium term profit held by investors so ideally that gets reset as seen in the SOPR model, but it doesn’t have to.

Macro Cycle View

Structurally, Bitcoin remains in a bullish regime, but the signals are clearly late-cycle.

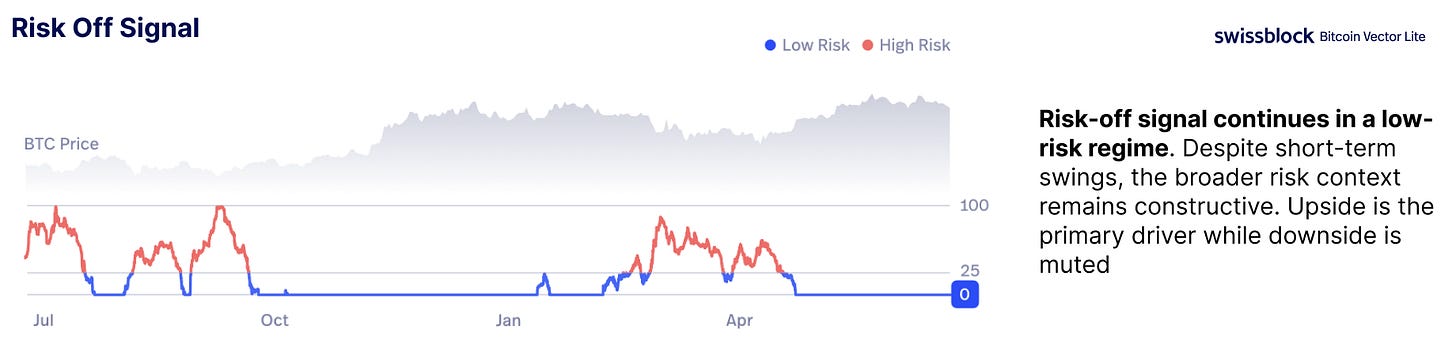

The Swissblock Risk-Off Signal, which tracks structural deterioration, not short-term volatility, continues to print a low-risk environment. Despite geopolitical shocks and $1B in liquidations, this signal has held at zero.

Willy Woo’s Macro Cycle Risk Model which tracks buying demand relative to structural stability is signaling late phase of this bull market and a countdown timer to the top has commenced.

This suggests the underlying market remains intact but vulnerable to fragility if fundamentals don’t improve.

Bitcoin Vector Lite Analytics

Our other publications and products

Bitcoin Vector Lite contains a core set of models ideally suited for a top level read of BTC structure. For a deeper dive you may enjoy our other products:

The Bitcoin Vector

The full range of models included for family offices and institutions.The Bitcoin Vector Advanced

Real time alerts of short term structural changes for professional traders, family offices and institutions.The Altcoin Vector

Designed to spot regime shifts and early momentum with precision. For professional traders.Hawkeye Terminal

Our real time framework, built for larger institutions. Limited to 10 seats.

Disclaimer

SWISSBLOCK DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES, REPRESENTATIONS, OR ENDORSEMENTS WHATSOEVER WITH REGARD TO THE REPORT. IN PARTICULAR, YOU AGREE THAT SWISSBLOCK ASSUMES NO WARRANTY FOR THE CORRECTNESS, ACCURACY, AND COMPLETENESS OF THE REPORT. NO INVESTMENT DECISION SHALL BE BASED ON THE INFORMATION CONTAINED IN THE REPORT, AND YOU ARE SOLELY RESPONSIBLE FOR YOUR OWN INVESTMENT DECISIONS. WE ARE NEITHER LIABLE NOR RESPONSIBLE FOR ANY INJURY, LOSSES, OR DAMAGES ARISING IN CONNECTION WITH ANY INVESTMENT DECISION TAKEN OR MADE BY YOU BASED ON INFORMATION WE PROVIDE. NOTHING CONTAINED IN THE REPORT SHALL CONSTITUTE ANY TYPE OF INVESTMENT ADVICE OR RECOMMENDATION (I.E., RECOMMENDATIONS AS TO WHETHER OR NOT TO “BUY”, “SELL”, “HOLD”, OR TO ENTER OR NOT TO ENTER INTO ANY OTHER TRANSACTION INVOLVING ANY CRYPTOCURRENCY). ALL INFORMATION PROVIDED BY US IS IMPERSONAL AND NOT TAILORED TO YOUR NEEDS. WE DO NOT EXPRESS ANY OPINION ON THE FUTURE OR EXPECTED VALUE OF ANY CRYPTOCURRENCY, AND WE DO NOT EXPLICITLY OR IMPLICITLY RECOMMEND OR SUGGEST AN INVESTMENT STRATEGY OF ANY KIND. BY USING OUR REPORT, YOU ACKNOWLEDGE THESE DISCLAIMERS.